Attn: Getting Business Credit Isn't Easy

Watch This Video To Learn Exactly How To Build $100K+ In Business Credit

Then Book A Call So You Can Start Building Your Own High Credit Limits Today!

MOST BUSINESSES WASTE OPPORTUNITIES

5 Business Credit Pitfalls to Avoid

Not knowing where to start, preventing you from even getting the credit lines you deserve.

Losing everything when you get sued. We use business credit to protect against that.

Getting stuck in an apply and get denied loop. Don't close because you waited too long.

Not having an entity and Uncle Sam taking your money. We'll set you up, get credit, & save on taxes.

Getting pennies in credit all because you did it wrong. We maximize your credit earning potential.

Attn: Getting Business Credit Isn't Easy

Watch This Video To Learn Exactly How To Build $100K+ In Business Credit

Then Book A Call So You Can Start Building Your Own High Credit Limits Today!

HOW WE WORK WITH YOU

Our Process Creates a Custom Game Plan to Maximize Your Credit and Protect Your Assets

Step 1: Discover

We learn about you, your goals, and if you would be a good fit for our program. Only some people are ready to build business credit. But that's ok. At the very least, we will point you in the right direction to work together in the future.

Step 2: Activate

We add you to our system and track you every step of the way. Unfortunately, the industry is set up in a way that requires leg work from you. But that’s ok, we tell you exactly what to do, what to say, and what to write. You barely even have to think.

Step 3: Execute

Our personal credit advisors guide you through the process. You will also have access to call them as the need arises. And once you start earning those higher credit limits, our business consultants will begin working with you to protect your assets.

MOST BUSINESSES WASTE OPPORTUNITIES

5 Business Credit Pitfalls to Avoid

Not knowing where to start, preventing you from even getting the credit lines you deserve.

Losing everything when you get sued. We use business credit to protect against that.

Getting stuck in an apply and get denied loop. Don't close because you waited too long.

Not having an entity and Uncle Sam taking your money. We'll set you up, get credit, & save on taxes.

Getting pennies in credit all because you did it wrong. We maximize your credit earning potential.

HOW WE WORK WITH YOU

Our Process Creates a Custom Game Plan to Maximize Your Credit and Protect Your Assets

Step 1: Discover

We learn about you, your goals, and if you would be a good fit for our program. Only some people are ready to build business credit. But that's ok. At the very least, we will point you in the right direction to work together in the future.

Step 2: Activate

We add you to our system and track you every step of the way. Unfortunately, the industry is set up in a way that requires leg work from you. But that’s ok, we tell you exactly what to do, what to say, and what to write. You barely even have to think.

Step 3: Execute

Our personal credit advisors guide you through the process. You will also have access to call them as the need arises. And once you start earning those higher credit limits, our business consultants will begin working with you to protect your assets.

See What Our Customers Had To Say

Edward Araujo

Texas Consumer Credit

Curtis Henderson

FICO Pro

Rick Sax

Credit Repair Law Firm Chartered

HERE'S WHAT YOU GET

Get The 'Extra Credit' Blueprint That Gives You The Capital and Protection You Need To Operate

Step 1: Set Up For Success

File the right paperwork so you become a legitimate business.

Set up standard business assets so lenders can research you.

Set up and prepare financial statements to share with lenders.

Step 2: Apply The Credit Ladder

Find the right sequence of credit lines and trade lines to apply for.

Secure the small credit lines to begin building trust.

Continually graduate into the larger and larger credit lines.

Step 3: Enter The Promised Land

Start securing credit lines that give you massive limits.

Acquire the large credit lines with NO personal guarantee.

Use your new large credit lines to invest in and impact your business.

Step 4: Protect Your Assets

Protect your home & investments from lawsuits

Use our unique strategy to protect both your business and personal assets

Everyone has their hand out… make sure you keep what you own

Step 5: Put More Money Back In Your Pocket

Keep more of your hard-earned money

Have more money available to reinvest in your business

Spend money on yourself instead of Uncle Sam

HERE'S WHAT YOU GET

Get The Capital and Protection You Need To Operate

Step 1: Set Up For Success

File the right paperwork so you become a legitimate business.

Set up standard business assets so lenders can research you.

Set up and prepare financial statements to share with lenders.

Step 2: Apply The Credit Ladder

Find the right sequence of credit lines and trade lines to apply for.

Secure the small credit lines to begin building trust.

Continually graduate into the larger and larger credit lines.

Step 3: Enter The Promised Land

Start securing credit lines that give you massive limits.

Acquire the large credit lines with NO personal guarantee.

Use your new large credit lines to invest in and impact your business.

Step 4: Protect Your Assets

Protect your home & investments from lawsuits

Use our unique strategy to protect both your business and personal assets

Everyone has their hand out… make sure you keep what you own

Step 5: Put Money Back In Your Pocket

Keep more of your hard-earned money

Have more money available to reinvest in your business

Spend money on yourself instead of Uncle Sam

Book Your FREE BUSINESS CREDIT STRATEGY CALL Below

Eliminate the confusion and stop getting denied. Take a free credit building strategy on the house.

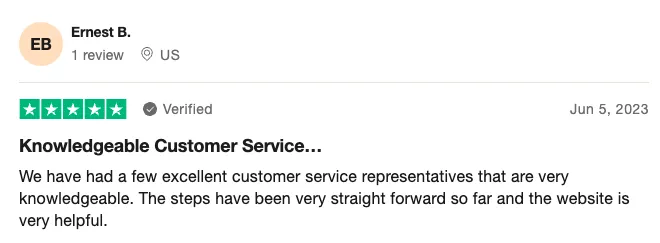

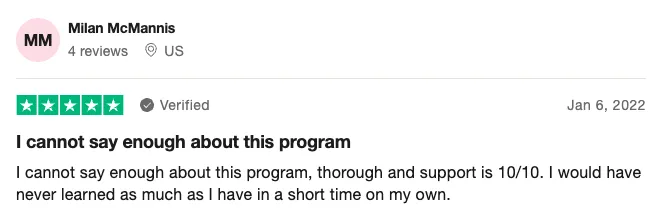

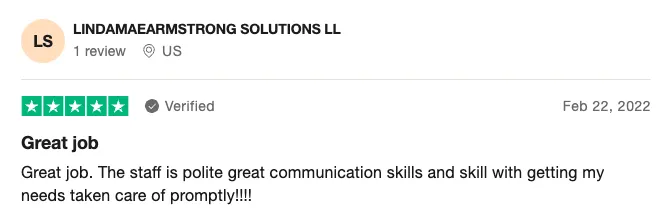

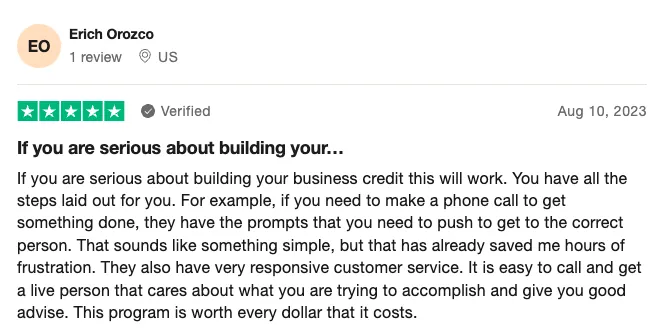

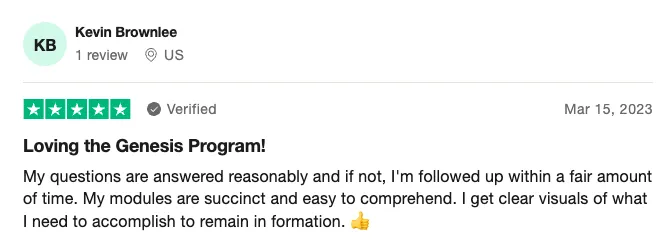

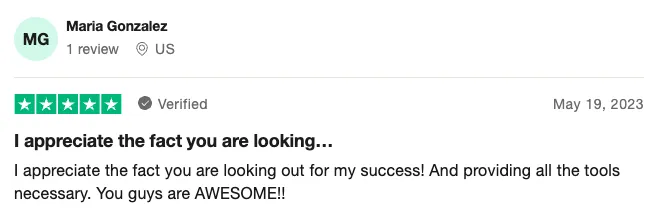

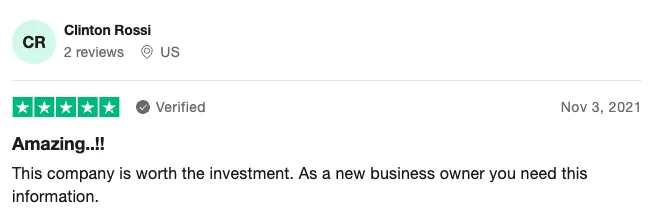

See what else our customers had to say

Book Your FREE BUSINESS CREDIT STRATEGY CALL Below

Eliminate the confusion and stop getting denied. Take a free credit building strategy on the house.

Our Customers Speak For Themselves

Frequently Asked Questions

What is business credit?

Business credit is a record of your business's financial transactions, such as loans, lines of credit, and payments made to vendors. It is similar to personal credit, but it is specific to your business.

How do I build business credit?

You can build business credit by opening a business bank account, using a business credit card, and paying your bills on time. You can also get a business loan or line of credit.

How do I get a business credit report?

You can get a business credit report from several different credit bureaus, including Experian, Equifax, and Dun & Bradstreet.

What factors affect my business credit score?

Your business credit score is affected by several factors, including your payment history, the amount of debt you have, the length of your credit history, and the types of credit you use.

How can I improve my business credit score?

You can improve your business credit score by paying your bills on time, keeping your credit utilization low, and getting multiple business credit lines.

What are the benefits of having good business credit?

There are many benefits to having good business credit. You will be more likely to be approved for loans and lines of credit, you will get better terms on financing, and you will improve your business's reputation.

What are the risks of having bad business credit?

If you have bad business credit, you will be less likely to be approved for loans and lines of credit. You will also get worse terms on financing, and you may have difficulty getting approved for contracts.

How can I protect my personal credit from my business credit?

You can protect your personal credit from your business credit by using a business credit card and by keeping your business finances separate from your personal finances.

What are some resources for building business credit?

There are several resources available to help you build business credit. You can check out the websites of the major credit bureaus, or you can work with a business credit consultant.

Our dedicated team specializes in getting small businesses $100K+ in business credit, safeguarding assets, and implementing effective tax-savings strategies. Elevate your financial future with tailored solutions designed to fortify your business foundation. Secure credit, protect assets, and optimize tax efficiency.

(866) 269-0429

info@augmentusinc.com

Our dedicated team specializes in getting small businesses $100K+ in business credit, safeguarding assets, and implementing effective tax-savings strategies. Elevate your financial future with tailored solutions designed to fortify your business foundation. Secure credit, protect assets, and optimize tax efficiency.

(866) 269-0429

info@augmentusinc.com

© 2023 Augmentus Business Solutions. All rights reserved.

Privacy Policy

Terms of Service